Consumers Credit Union also offers business money market accounts, business credit cards, business loans, business savings accounts, and other business services. Of the three options, Chase Business Complete Checking℠ is best suited to small business owners, based on the number of transactions and the number of cash deposits that it allows. This account isn't entirely free, but Chase offers multiple ways to waive the monthly service fee and gives you convenient access to your account via the mobile app.

We ranked Chase as the best overall bank for small businesses. We selected the Business Advantage FundamentalsTM Banking account as one of the best bank accounts for self-employed professionals. With its many product offerings, you can expand your financial relationship easily to help fulfill your financial goals.

As your business scales, you can conveniently meet with a Chase representative at one of the thousands of branch locations nationwide to discuss further banking opportunities. Not only can you earn interest on its small business checking account, but First Internet Bank also offers competitive rates on business savings accounts, business CDs, and a variety of loans. The variety of loan products and banking services that First Internet Bank offers is why we named it as one of the best banks for real estate investors. These are our choices for the best online business banks because of the options and services offered by each. These online business accounts come with incentives for keeping a healthy cash flow and balance, the most notable incentive being the ability to waive monthly maintenance fees.

In addition, they come with the accoutrements necessary to run a smooth business, such as free cash deposits, free transactions, discounted business checks, and debit and Visa cards, if required. It includes one of the nation's highest-yield business checking accounts―0.60% APY on balances up to $100,000―with no monthly fees, penalties, or minimum balance to maintain. Larger businesses with more sophisticated cash flow and financial needs will find this Citibank business online banking account suitable. This is one of the online business accounts that comes with unlimited check writing, making it easier for businesses to pay vendors and carry out several daily transactions. This Chase online business banking account is for mid-sized businesses with basic cash flow needs.

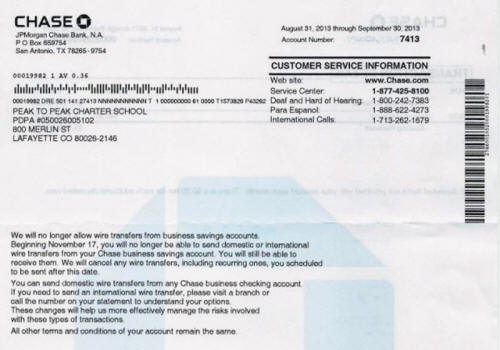

This account carries a $20 monthly maintenance fee, and this monthly fee can be waived if account holders maintain a $20,000 qualified balance. The account holder receives 350 free transactions for each statement cycle and $20,000 in cash deposits without incurring any charges. This online business account comes with two free domestic wire transfers, and there are international wire transfers available for a price. As one of the oldest banks in the nation, Chase maintains a reputation for prioritizing its customers' needs. While it offers three different checking accounts, we selected Chase's Business Complete BankingSM account as the best fit for small businesses.

It offers unlimited electronic deposits and transfers and 20 free transactions per month, all for a nominal $15 monthly maintenance fee that can be waived easily―see below under Fees & Terms. As an added perk, you can receive a $300 bonus if you open a new account online or in-person and complete qualifying activities. That makes it a great fit for growing companies and those interested in doing all their business banking in one place. All of our choices for the best free business checking accounts either don't charge monthly fees or offer ways to waive the monthly fee easily by meeting minimum requirements.

Chase is the biggest bank in the U.S. and for that reason, it is a reliable business checking solution for small to large business owners. The monthly maintenance fees are pretty easy to avoid if you maintain the basic minimum monthly balances. Despite their size, they offer less innovative cash flow management features than some other business checking accounts do.

For a smaller business looking to bank online exclusively, there might be better signup deals or simpler interface with lower fees to meet their needs. Chase is designed especially to accommodate medium-big business. This Chase online business banking account is specially designed for larger businesses with more complex financial needs and a higher volume of transactions. For maintaining a qualifying balance of $100,000, this online business account's monthly maintenance fee of $95 is waived.

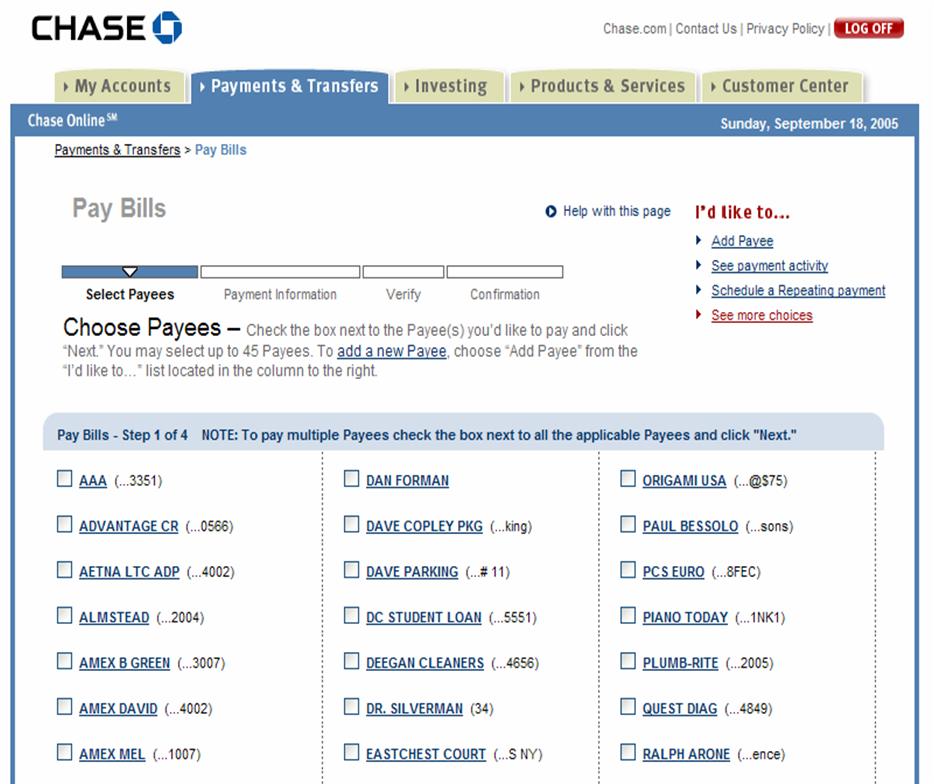

In addition to unlimited incoming wires and electronic deposits, 500 free transactions each month. Chase for business offers business checking accounts, business credit cards, and a range of other business services. This article will focus on the business checking accounts you can choose from, including exploring the features, fees, and Chase business account requirements you need to know about. This account comes with a monthly maintenance fee of $30; however, that fee can be waived if the online business account holder maintains a minimum average monthly balance of $10,000.

To determine the best selection, we considered dozens of small business checking accounts that charge minimal fees, provide strong support, and offer many features important to small business owners. We compared APYs, maintenance fees, initial deposit and minimum balance requirements, branch and ATM availability, online and mobile banking features, and additional account perks for each bank. If one of your financial goals is to save funds by not paying unnecessary fees, Capital One's Spark Business Basic Checking is a great choice. While this account does have a nominal monthly fee, it's easy to meet the requirements to have the fee waived.

This checking account is the only one on our list that offers both in-person banking as well as unlimited free transactions. It's so easy to save on fees with this straightforward account, named one of the best business checking accounts for limited liability companies . It is important to consider the best business checking accounts for startups and entrepreneurs since business banking is a fundamental requirement for every business. Every entrepreneur needs a business bank account to pay their business insurance, take care of payroll, collect money, have a merchant account to accept credit card payments, and so forth. One of its most compelling features is its checking account that offers 0.60% APY on balances of up to $100,000.

This is one of the highest yields in the nation, with no monthly fees, penalties, or minimum balance to maintain. Check deposits can be made via the mobile app and cash is accepted at more than 90,000 Green Dot retail locations nationwide—a $4.95 fee will apply to each Green Dot deposit. The US Bank Silver Business Checking is one of the best deals in business checking accounts for side hustlers and small businesses. This account has $0 monthly maintenance fees, online banking, mobile check deposit, online bill pay, and more. To determine which business checking accounts offer the most convenience,CNBC Selectanalyzed dozens ofU.S. Business checking accountsoffered nationwide by online banks as well as those with physical branches.

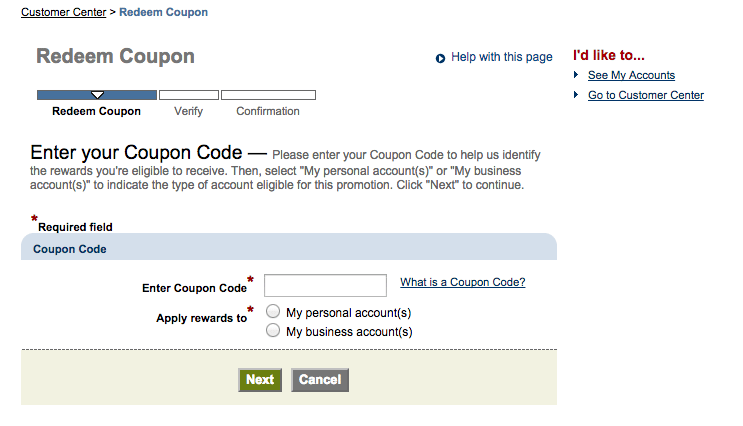

We narrowed down our rankings by considering no-fee checking accounts or accounts with easy ways to waive the monthly maintenance fees. The monthly fee for this Chase online business banking account is $10 a month, but it is $12 a month if you choose to receive paper statements. The entire monthly maintenance fee can be waived if a minimum daily balance of $1,500 is maintained. Chase offers point of sale solutions that you can use with any of its business checking accounts. The Chase QuickAccept tool lets you accept both credit card and debit card payments with an easy to understand fee structure and same-day deposits of the payments you receive. It offers many ways to save through its Small Business Checking account with no minimum balance requirement, no monthly service fee, and unlimited transactions.

Its interest-earning account yields 0.30% APY if you maintain an average daily balance of $10,000. Both its online banking and the mobile app are robust and highly rated. You'll also need to keep a minimum daily balance, which varies based on account type. You have access to unlimited electronic deposits, which include deposited items, ACH transfers, ATM transactions, debit card purchases, internal transfers and Chase QuickDeposit . This provides a high level of flexibility with online payments, similar to what you'll find with many online-based business checking accounts. However, you'll pay a $25 monthly fee if you can't keep a $15,000 balance in all of your Chase bank accounts and partner investment accounts combined.

Chase Business Complete BankingSM is a small business checking account from one of the largest banks in the United States. It's best for businesses that want a physical bank branch to visit for in-person customer service and banking. It requires a monthly fee of up to $15 if you don't maintain a $1,500 minimum daily balance. Keep in mind that while these online business accounts can facilitate business banking online, it is not possible to open business checking account online free of charge through these banks.

This is to verify the documentation that demonstrates you are a business owner. Finding a free business checking account that meets all of your business banking needs can be a challenge, and most of the truly fee-free accounts are hosted by online-only banks. To best represent the varying banking needs of small businesses, when compiling this list, we also considered traditional business bank accounts that have low and easy-to-waive fees.

While business checking accounts generally aren't as generous as business savings accounts in the interest department, some major banks do at least pay token interest on deposits. For instance, Wells Fargo's top-tier business account is interest-bearing. While some of these fees are unavoidable, such as the wire transfer costs, the maintenance fees on checking and savings accounts are completely avoidable.

You can also skirt the fee if you direct deposit $500 or more per month. Wells Fargo offers a Wells Fargo online business banking account called Wells Fargo Business Choice Checking. This account comes with 200 free transactions, and $7,500 a month in cash deposits can be made at no additional charge. The required minimum balance needed to open this account is $25. Chase is one of many banks that offers business checking accounts. Whenever you're thinking about opening a new bank account, applying for a loan, or signing up for a new credit card, it's worth shopping around.

With a BlueVine business checking account, you get an account that offers unlimited free transactions, pays a healthy interest rate on your account balance and doesn't charge a monthly maintenance fee. Its dynamic banking platform includes online and mobile banking and provides integration with major accounting software like Wave, FreshBooks, and QuickBooks. It gives you the most free transactions and cash deposits, but it has one of the highest monthly fees we've seen. And to waive that maintenance fee, you'll need a daily average of $100,000 in your business banking or investment accounts.

Based on the criteria we share below, here are our choices for the best business checking accounts available. Some of these accounts are basically free, while others do require some minimum balances and/or other requirements to waive the monthly fees. All three Chase business checking accounts can be facilitated online, but opening an account requires going to a branch. The difficulty with business banking online through Chase Bank is that the fine print and details required for understanding each business bank account is not made available on the website. Business owners must visit a branch in order to gain full information, and they must bring the necessary documentation verifying their business's existence if they wish to open an account.

Chase is a large bank that offers both personal and business banking services. It offers three different types of business checking accounts, each serving different size businesses. The Chase Business Complete Banking℠ account stands out as one of the most flexible brick-and-mortar business checking accounts on the market. It places few limitations on transactions and gives you the best of both worlds with a large branch network and user-friendly online tools. Plus, you don't need a separate merchant services account to accept credit card transactions. If you haven't set up a dedicated business bank account yet, or if you're in the market for a new one, a Chase Business Complete Checking account is worth your consideration.

But you should be aware that those same monthly service fees can be as high as $15, depending on how you use the account. On a more attractive note, if you're willing and able to complete a few qualifying activities, you could wind up enjoying a $300 bonus when you open a new Chase business checking account. Chase Business Complete BankingSM is the flagship business checking account from Chase, one of the largest banks in the world.

But before signing up, check minimum balance requirements and potential fees to make sure it's a good fit. You'll also need to consider other banking products that you can access online. This includes things like business savings accounts, merchant services, credit cards, and small business loans. Among the Chase business checking accounts, Business Complete is the only one that lets you use Chase QuickAccept to accept credit card payments with the Chase mobile app. This integrated credit card processing service is pay-as-you-go and connects with a mobile card reader to tap, swipe or dip transactions. Chase Business Complete Checking℠, formerly known as Chase Total Business Checking, offers essential banking features for small-business owners.

This business bank account includes unlimited electronic deposits, access to Chase branches and ATMs and the ability to deposit cash, write checks and send and receive wires. Transaction Fees will not be charged for all electronic deposits and the first 250 debits and non-electronic deposits each statement cycle. There will be a Transaction Fee of $0.40 for each debit and non-electronic deposit above 250. Electronic deposits are deposits made via ATM, ACH, Wire and Chase QuickDeposit. The first $20,000 in cash deposits per month with no fee (standard cash deposit fees apply above $20,000). Fees and product features are subject to change at any time.

Linking for pricing purposes will not affect your statement and does not link account for overdraft protection. The new business checking account provides relationship benefits with multiple ways to waive fees, including purchases made with Chase Ink business credit cards and payment processing volumes. US Bank is one of the best business checking accounts for startups and entrepreneurs wanting to learn how to build business credit and get an SBA 7 loan.

This bank has lots of branches; last we checked, they had 3,067 branches. They also have great customer service and tend to work well with businesses seeking out business loans, especially through the SBA 7 loan program. Chase is one of the largest banks in the United States and has an impressive 5,100 branches throughout the country and 16,000 ATM locations. We have picked checking accounts based on our opinions of how easy they are to use, their costs and fees, any interest rates and bonuses provided, and a variety of other factors. We believe that our list accurately reflects the best business bank accounts in the marketplace for side hustlers, small business owners, and freelancers.

This Chase online business banking account comes with 200 free transactions per month and $7,500 in cash deposits each month without incurring a fee. This online business account comes with $50,000 of cash deposits and withdrawals each month. If the cash deposits or withdrawals per month exceeds $50,000 for four months in a rolling 12-month period, the bank may upgrade the account. Each business account offers valuable services backed by recognizable brands, but deciding on the best online business bank requires identifying which products and features match your business's needs. It will also go over how to open a business checking account online free of charge.

Chase's business checking accounts are a solid option for anyone with a physical business that needs to accept card payments and deal with cash. Most businesses will be best served by the Complete Checking account, which has a relatively easy to avoid monthly fee. Unlike some of the other accounts on our list, the Chase Business Complete Checking account does charge a monthly maintenance fee; however, there are several ways to have the fee waived. For small businesses that have minimal monthly banking transactions, this account can be fee-free. The benefit of banking with Chase lies in the nearly 5,000 branches and 16,000 ATMs nationwide that make it easy to find a Chase branch near you.

For those that prefer to conduct their banking transactions in person or require other services provided by a brick-and-mortar bank, Chase is a great choice for your business banking needs. In addition to checking accounts, Chase also has some of the best business credit cards on the market today. You'll also benefit from merchant services and online business lending solutions if you need them.

The Business Advantage Fundamentals Banking has a $16 monthly fee, which can be waived if the average account balance is kept over $5,000. While many consumers these days don't frequently write checks, there is a significant advantage to owning a business checking account. As you can see above, monthly maintenance fees and low interest rates are the two biggest drawbacks of Chase business savings accounts.